Earlier this month we were featured on National Mortgage News to share perspective on the quickly changing macroeconomic environment and the impact your title partner can have on your customer experience.

The mortgage industry has undergone tremendous change. The current combination of record-low housing inventory, historically high inflation, skyrocketing interest rates, and staggeringly high home appreciation is a breeding ground for uncertainty and has left lenders to face decreasing volumes and declining revenues. Amidst this environment, it is important for lenders to focus on delighting customers to differentiate themselves and future-proof their business.

The ROI on A Great Customer Experience

Lenders who have invested in their customer experience have risen to the top, gaining market share and displacing large banks. These winners have made rigorous investments in technology and maintained an unwavering focus on customer experience. Customers’ expectations continue to grow, which means lenders must focus on speeding their operations to provide a transparent, fast closing experience.

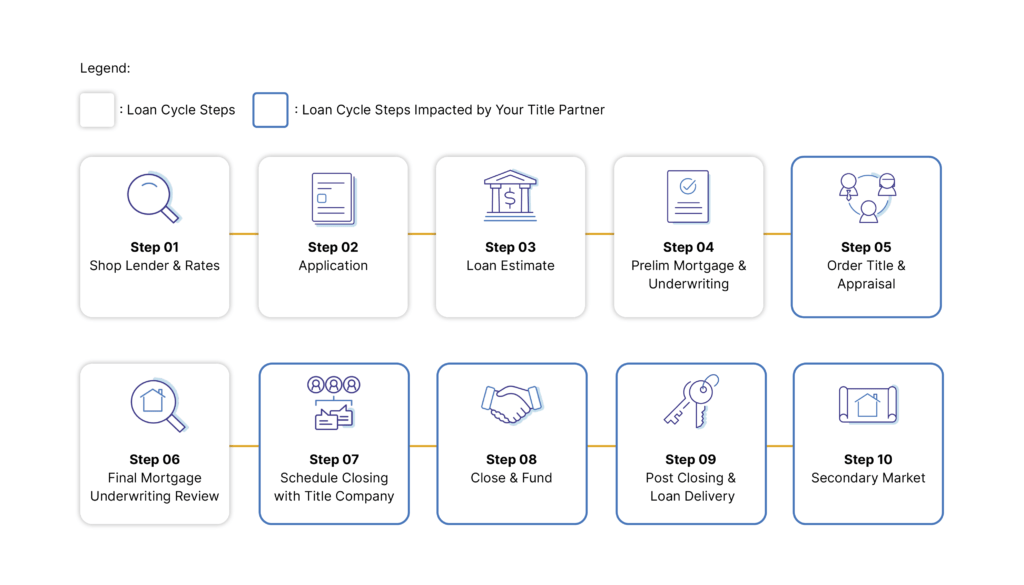

Your Title Partner’s Impact on Your Loan Cycle

Your title partner impacts 50% of your loan cycle. Sometimes this process is slow and cumbersome, resulting in negative customer impacts, so it is crucial to know where your title vendor can help drive better outcomes. It’s important to ensure they are aligned with your vision of creating an outstanding customer experience.

How to Re-engineer Your Customer Experience

Re-engineering your customer’s experience requires you to step into their shoes and breakdown the workflow to track every touchpoint you have with them. Once you have taken this step, identify areas where you can integrate to drive efficiency, especially with your vendors. Build processes around your customer, not around your team. Finally, measure for impact and identify ways to track the performance of your internal teams as well as your vendors to ensure they are meeting your high standards.

Supporting a Robust Digital Experience

The Bank of America Homebuyer Insights Report shows consumers have been longing for more digital solutions in the mortgage space, in fact 69% of borrowers prefer to submit financial documents using digital tools. A digital front-end experience needs to be supported by partners who are also leveraging technology to deliver a flexible, seamless online experience.

It pays dividends to have a title partner aligned with your customer-first vision, to learn more check out the webinar replay.