Sierra Pacific partners with Doma to gain a competitive edge and provide customers more efficient and affordable refinancing.

Incorporated in 1986, Sierra Pacific Mortgage Company, Inc. is one of the oldest and largest independent mortgage lenders in the U.S. With headquarters in Folsom, California, the company serves retail, wholesale and correspondent mortgage banking markets in 48 states through five regional fulfillment centers. It originates billions of dollars in residential loans nationwide as a direct lender.

Sierra Pacific’s mission is to deliver consistent, competitive pricing, and to provide its customers the smoothest experience through streamlined systems, the best industry tools, and effective communication. The company expresses this more succinctly in its motto: “Promises Made, Promises Kept.”

“The dream of owning a home has changed little in the past 30 years but the reality and road to get there has changed significantly,” says Jay Promisco, Chief Production Officer, Sierra Pacific Mortgage, Inc. “The average price of a single family home has more than doubled since the 1980s, and given the size of even a modest home loan, finding a trustworthy, efficient mortgage provider has become more important than ever before. We deliver outstanding customer service and value across the country and are dedicated to being at the forefront of the mortgage industry for the next 30 years and beyond.”

“This is the Amazon effect we were looking for and we are excited to roll out predictive underwriting for wider adoption.”

Future Proofing the Company

Even after three decades at the helm, President and CEO, Jim Coffrini, has never been one to let Sierra Pacific rest on its laurels. The company’s more than 150-strong fulfillment team does everything it can to surpass customer expectations, which earns referrals and return business for multiple resale and refinance transactions.

With a proven track record of providing the level of customer service homebuyers expect of an MPA Five Star Lender and nearly a decade of stability secured since 2008, Sierra Pacific hired Jay Promisco as Senior Vice President of Retail Lending to help restructure and future proof the company in the Fall of 2017.

Jay started his career in banking at Dean Witter and went on to join eTrade Financial and Barclays Global Investors before switching to mortgage financing in 2003. Having learned the ropes at GreenPoint Mortgage and Wells Fargo, Jay joined Stearns Lending where he rose through the ranks to Executive Vice President of Joint Ventures. Jay capped off 10 years with the successful sale of Stearns Lending to Blackstone, the world’s largest alternative investment firm.

“In mortgage refinance you have to impress the homebuyer enough for them to refer you and even return several years later,” says Jay. “Jim knows residential real estate and practically every segment in the industry are in the process of digital disruption, and although I was fortunate to join a highly competent team with a national footprint, we needed everything to be buttoned up to maintain and grow our competitive advantage. A decade in banking teaches you how to optimize the numbers, and a decade in retail lending teaches you how to optimize the offering. What I learned in both is how to restructure systems and procedures to ensure our people are free to focus on the customer and elevate the experience.”

Scaling in an Amazon World

The modern consumer wants products and services delivered on their terms, and that can look different for each borrower. Sierra Pacific estimates that 18-25 percent of homebuyers and owners want to do everything online. The numbers are higher for refinancing, as it’s a more purely financial transaction, and higher still for customers on their second and third property. Millennials, who grew up surrounded by digital solutions such as online banking, still want to be led through the process – at least for their first mortgage and purchase.

Objectives

- To drive efficiency and reduce costs for Sierra Pacific’s operations, processes and services

- To clean up, overhaul and streamline all back-end and front-end tech stacks

- To prepare the company to meet and exceed the evolving expectations of the modern homebuyer in an industry that is waking up to a wave of technological disruption

Challenges

- A modern consumer that has become accustomed to a convenient service at the speed of Amazon, instant credit approvals and an abundance of online comparison sites

- The saturation of the mortgage industry with barely differentiated offerings

that impacts costs and margins - Legacy practices, procedures, people and politics, and a threadbare

landscape of resale and refinance solutions

“We rely on our vendors to look at the entire space holistically, to keep up with compliance requirements and to help us stay ahead of the curve.”

“The customer has become increasingly impatient, and sometimes, they only decided they want a mortgage that morning,” says Jay. “It’s the Amazon effect – resale or repurchase, everyone wants fast without the back and forth – and it’s easier than ever before for the customer to shop around. Sierra Pacific already offered one of the most efficient underwriting services in the industry when I arrived, but we know that ‘one of the fastest’ now will be considered mediocre in a few short years. Having renegotiated with our credit report and appraisal vendors we were able to pass the savings on to our customers and achieve a higher win rate. The next step was to find a disruptive technology that would truly differentiate our offering.”

Selecting a Strong Partner

Sierra Pacific is highly selective about who it brings in to optimize and accelerate growth. The company only uses stable technology vendors, which takes strong financials, dynamic leadership and unwavering commitment. Whenever possible, it looks for vendors with deep experience in residential real estate financing that can fix short-term problems while executing on long-term plans. Given ever-changing compliance requirements and consumer expectations, Sierra Pacific also looks for vendors who offer cutting edge innovation and can tailor their software to suit the company’s specific needs.

When Jay was first introduced to Doma, a leading U.S. title and settlement services provider with a machine intelligence-driven solution, his interest was piqued by the potential to save significant time and money at scale. While still renegotiating with his current vendors, Jay kept in touch with Doma, which allowed him the time to understand how an instant experience could help him overcome his primary challenges and achieve his key objectives. Jay was also able to do the necessary due diligence to ensure Doma met Sierra Pacific’s high vendor standards.

“There are a million vendors trying to add value,” says Jay. “What’s really important to us is that our partners understand mortgages, how business is generated, why it is generated the way it is and all the moving parts that make a mortgage happen. We rely on our vendors to look at the entire space holistically, to keep up with compliance requirements and to help us stay ahead of the curve. Integrating a new vendor is expensive and unnecessarily switching vendors wastes money, so we look for partners with serious capital and leadership behind them, who are committed to providing value in the mortgage space and will help us stay at the forefront of the mortgage industry now and in the future.

The Doma team was patient and thorough, did a wonderful job of explaining the onboarding process, and walked me through current features, expected benefits, and the product vision. From financials and leadership to technology and benefits, Doma checked all the boxes.”

Pilot Best Practices

- Step 1: Select a specific group for the pilot

- Step 2: Know and share your benchmarks

- Step 3: Define processes and parameters

- Step 4: Track, report and discuss

“Our value proposition is now a combination of lower rate fees, great service and accurate work, and industry-leading turnaround times.”

Getting Adoption Right

In June 2019, Sierra Pacific launched a pilot of Doma’s instant underwriting solution for mortgage refinance with a select group spread across Arizona and California, and in July, the company extended the pilot to Minnesota. Although the solution was fast and simple to set up, Jay still had to convince brokers who were used to going to the same vendor, often for decades, to make the switch.

Jay enlisted some of his top brokers to use the solution for 60 days and then provide feedback. When each team member closed their first order using Doma, they saw for themselves how much time the solution saves and began to understand the potential cumulative value of the tool. Adoption accelerated after customers responded positively to how fast Sierra Pacific’s Consumer Direct team could now respond and how much money they saved.

“Our business is relationship-based and it takes time to trust a new solution the way you trust a vendor you’ve worked with for years,” says Jay. “To begin with, when we rolled the Doma solution out to a number of team members, they waited for the next order but then would go to their usual vendor. Frankly, they didn’t believe underwriting could be instant – especially at the lower price point – and old habits are hard to break. That all changed when we instituted a mandatory 60-day trial period. All they needed was their login and credentials and it was awesome every time we got an instant response. It made a huge difference and each time a team member had their first successful order, I would get feedback like: ‘We were immediately clear to close – it was fairly magical.’ Soon the feedback loop extended to our customers and we had broken free from the status quo.”

75% Reduction in Transit Time

A New Value Proposition

By the end of the initial pilot, Sierra Pacific saw that – for 93 percent of title insurance orders processed with Doma in 2019 – the company received a clear-to-close title commitment in under a minute.

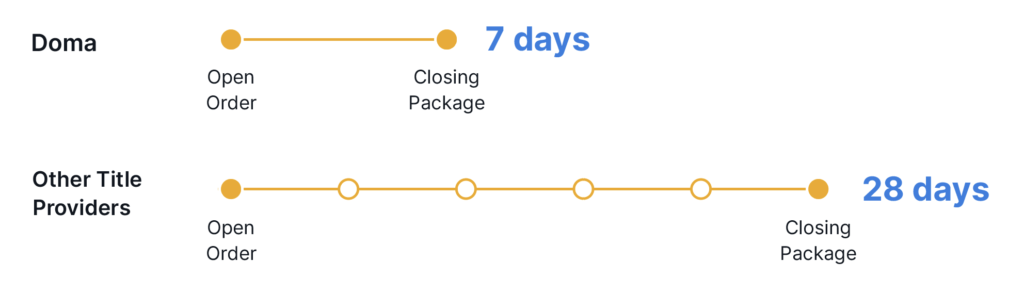

The Doma solution automatically pulls data from multiple sources, which removes a lot of the heavy lifting and allowed the Loan Officers to focus on driving the closing disclosure. By streamlining processes with Doma, vendors such as ClosingCorp and Finicity, and property inspection waivers (PIWs) through Freddie Mac’s Loan Prospector (LP) and Fannie Mae’s Desktop Underwriter (DU), Sierra Pacific completed a process that usually takes 28 days in just seven days.

Jay noticed that branches involved in the pilot did not require borrowers to spend as much money to close on a loan, had a higher proportion of pricing requests complete as a deal and enjoyed higher overall win rates. And during the first nine months, Jay received no customer service complaints from Brokers or Loan Officers, suggesting every Doma-supported transaction met or exceeded customer expectations.

“Typically, a customer has to prioritize two out of three factors: cost, quality of delivery and speed,” says Jay. “Doma is highly competitive on price across the country, and in Minnesota, its settlement services cost half as much. Whatever the Doma team is doing to ensure quality delivery, it’s working – I have had exactly zero customer issues. And, because Doma massively reduces manual input, closing takes us 75 percent less time from start to finish. Our value proposition is now a combination of lower rate fees, great service and accurate work, and industry-leading turnaround times. We don’t have to compromise, and neither do our customers. Doma gives us a competitive advantage on every transaction, with every returning customer and in the industry at-large. This is the Amazon effect we were looking for and we are excited to roll out predictive underwriting for wider adoption.”