Homepoint turns to like-minded Doma to quickly ramp up support for an efficient, closing experience

It isn’t easy being the new kid on the block. Just ask Homepoint Financial Corporation, which launched only five years ago with the goal of becoming a top-10 mortgage originator and servicer. It was also dedicated to bringing speed and simplicity to the mortgage transaction, disrupting the five legacy mortgage lending brands that together hold a 30-percent U.S. market share.

From its humble beginnings in Ann Arbor, Mich., in 2015, Homepoint doubled its loan volume in each of its first four years. With 178 percent year-over-year growth in the last year, it is now the second-largest wholesale mortgage lender in the country, and the 18th-largest mortgage lender across all production channels.

Forecasting growth in annual loan volume to top $60 billion in 2020, Homepoint has set its sights on delivering an efficient and smooth mortgage closing that is powered by data, but uncompromising in quality of service and experience. To that end, Homepoint earlier this year partnered with like-minded Doma to apply its efficient machine intelligence solution and bespoke customer service model to give the current complex, onerous closing a much-needed modern upgrade.

“We believe, in the future, that once a customer gets into the mortgage ecosystem, the next mortgage they do will be so simple, straightforward and data-driven.”

Objective: Connect the Value Chain

When Homepoint launched in 2015 – as a startup that purchased a small mortgage bank as its entrée into the business – the U.S. housing market was nearing a decade of recovery from the 2008 financial crisis. Anticipating that transaction volume would increase as mortgage rates dropped, the resilient, nimble company began executing toward its ambitious vision.

“We’ve always had an ambition of becoming a top-10 originator and servicer,” Willie said. “All of our new customers come through the mortgage brokers and correspondent lenders. We have a servicing platform where we service over 280,000 of our customers and households today. We also have a very robust capital markets function, which we’re currently in the process of extending into asset management.”

Homepoint’s first order of business was “to do what we call, ‘connect the value chain,’” Willie said.

“We believe, in the future, that once a customer gets into the mortgage ecosystem, the next mortgage they do will be so simple, straightforward and data-driven,” said Willie Newman, CEO and President of Homepoint. “The current infrastructure that’s been built to process loans and to handle the flows of information associated with gathering and collating physical information will all go away.

“We’re not selling customers. We’re not shipping services out, which strategically gives us the best opportunity to optimize the value of the mortgage assets we create,” he said. “As a servicer, we believe the value chain is extremely important. That’s the best place from which you can collect data from the customers you’re servicing on an ongoing basis in a very two-way, transparent manner in order to facilitate in order to facilitate the next transaction in a way that really is instant and proactive.”

“You can collect data from the customers you are servicing on an ongoing basis in a very two-way, transparent manner in order to facilitate the next transaction in a way that really is instant and proactive.”

Key Results

-

895

orders across 11 states in first two months of the partnership (May and June 2020)

-

80%

of orders received an instant title decision in under a minute (86% in California)

-

70%

of inquiries handled directly by Homepoint’s dedicated Doma Remote Team

-

16

minutes of average response time on 80% of files, with all responses provided within 1 hour

Acknowledging the Pain Points

As a 30-year veteran of the mortgage industry – including five years building Homepoint from the ground up – Willie understood how pervasive issues such as late, dropped, or missing email responses, essential conversations, and documents required to achieve a timely clear to close frequently impact the mortgage closing experience. Homepoint’s long-term customer retention strategy, powered by technology, enables it to retain more than 99 percent of the loans it originates for servicing. However, the company noted that its customers’ homebuying or refinance experience was still marred by inefficiencies in notarization and signing processes, personnel issues, and costly errors, resulting in each step in the process taking days to weeks to complete. With its title and escrow providers offering limited visibility into how elements of the transaction were progressing, Home Point sought out a title partner that could provide trackable metrics and improvements to optimize the value chain. “Frankly, with the title insurance segment, I guess personally, I’ve always been looking for a better way,” said Willie. “It really does get to the point where things are challenging enough, where innovation not only becomes desirable, but necessary.”

“Seeing Doma’s ability to execute and always stay true to the vision of, ‘We’re really going to change how this is done,’ and to change in a way that not only makes sense, but is very good from a customer experience standpoint.”

Identifying a Progressive Title Partner

Homepoint craved innovation in the century-old riskelimination and mitigation model of title insurance, envisioning a blend of title expertise and a datadriven process. “The physical and time consumptive nature of it – especially as we’ve developed from a data and digitization standpoint – just didn’t really make sense,” Willie said.

Homepoint and Doma had watched each other’s journeys as the companies grew up. The companies were closely aligned in their vision of a better consumer mortgage experience, and a shared belief in a carefully curated mix of knowledgeable employees and a data-enabled process.

“The more I heard about Doma, the more I said this is an idea that is way overdue,” Willie said. “Seeing Doma’s ability to execute and always stay true to the vision of, ‘We’re really going to change how this is done,’ and to change it in a way that not only makes sense, but is very good from a customer experience standpoint. I think that really it was just a matter of time until both of us were at the level of scale and reach from a market standpoint where it made sense for us to partner.”

While Homepoint was attracted to Doma’s service model and vision, the company was particularly impressed by the expertise, structure, service level agreements (SLAs), and sense of ownership of Doma’s concierge teams. Homepoint also trusted Doma to support its workflow optimization preferences based on what the company and Willie consider best for the business and the customer experience.

Homepoint SLAs

Order payoffs for outside lenders

Communicate with the borrower on lien or vesting questions

Provide notifications at important milestones in the closing and signing process

Provide a CTC notification with borrower vesting and cleared liens

Weekly reports with file status, including scheduled closes and files awaiting funding or disbursement

Extraordinary Results in an Unprecedented Time

In early 2020, Doma worked with Homepoint to integrate with its third-party technology solutions, including Encompass, Docutech, and Smart Fees. Homepoint was already keen to use Doma’s remote closing solution to resolve notarization and signing discrepancies and delays when the novel coronavirus, COVID-19, became a pandemic, necessitating creative solutions to closing loans in a socially distant environment.

Successful Pilots

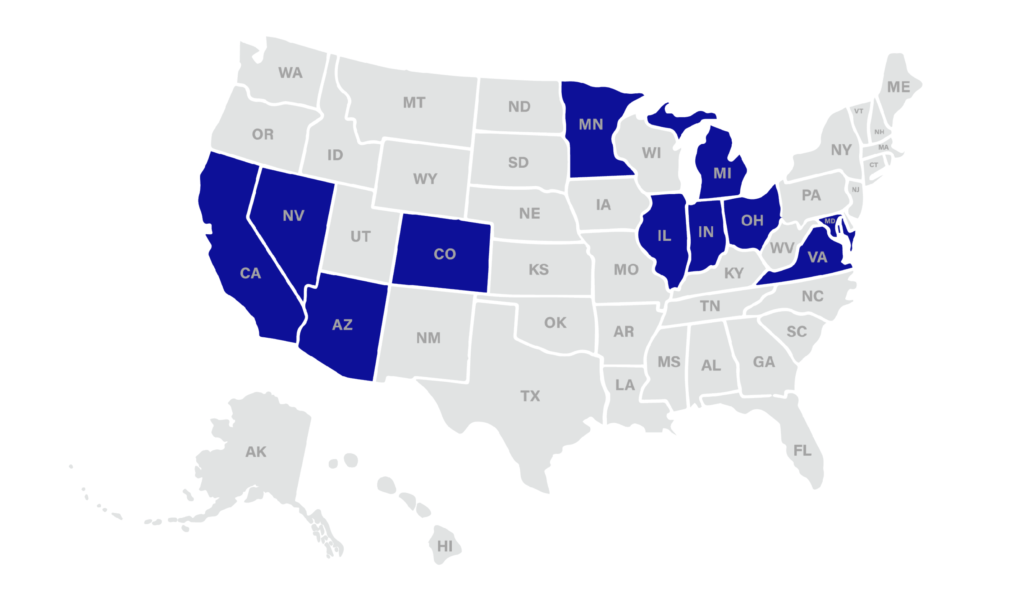

Homepoint completed due-diligence efforts and was about to sign with Doma as widespread lockdowns and travel disruptions emerged nationwide. Doma assigned to Homepoint a dedicated Remote Team of title and escrow experts. Normally based in an Irvine, Calif., office, the 100- percent remote team began processing files and tested a rollout in four states: Colorado, Minnesota, Maryland, and Ohio.

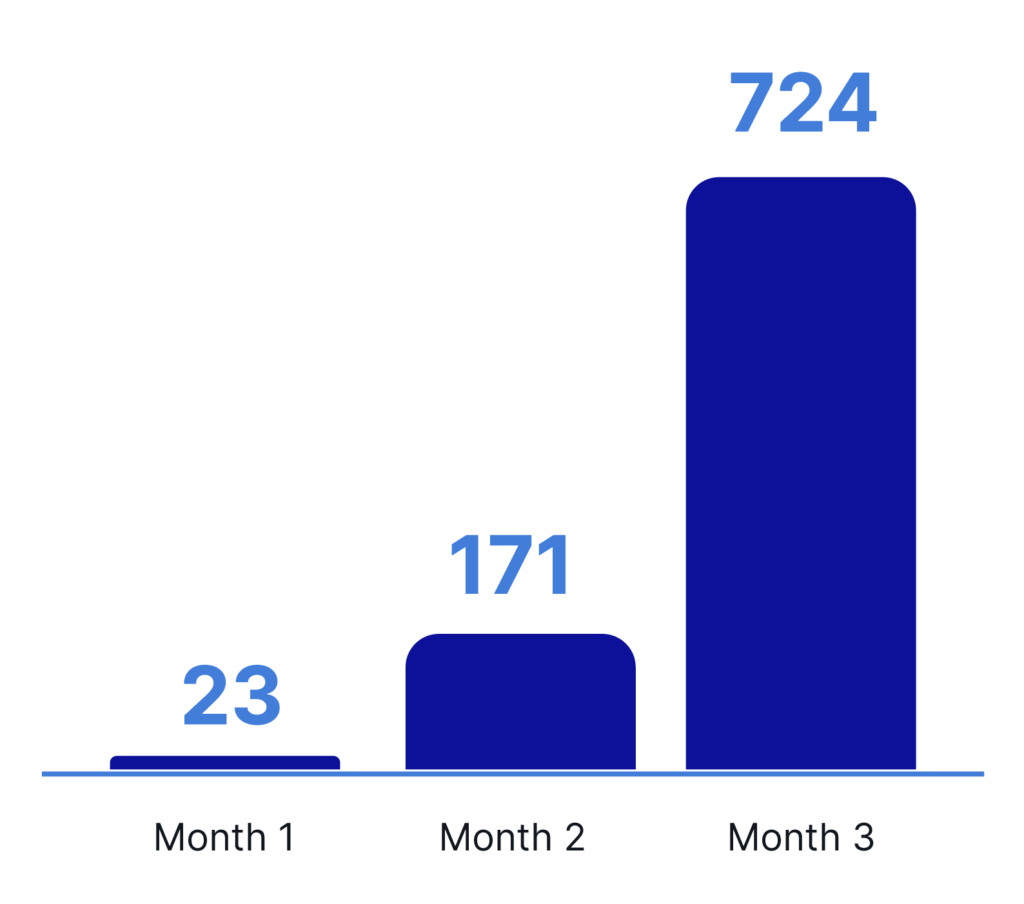

Two months into the pilot, Homepoint had also conducted successful pilots in Michigan and Virginia, processing 171 orders in seven states and completing more than 80 percent of those orders using Doma’s instant underwriting solution. During the Homepoint pilots, the Doma concierge delivered prompt, complete responses to approximately 70 percent of the company’s inquiries, leveraging the expertise of the production team to resolve complex issues. All questions received a full response within an hour of receipt, and the production team delivered complete resolution within 16 minutes for 80 percent of inquiries.

By using a Remote Team, Doma was able to ensure experts handle the file separately according to their specialty, and together to ensure on-time delivery.

“To the extent things go bumpy or sideways with a new vendor, whether it’s a single transaction or maybe an understanding of how things work, you want a quick and complete response, because anyone who thinks things are going to go perfectly from day 1 is just being naive,” said Willie. “The ability to respond quickly, work together, and say, ‘OK, here’s how we’re going to work through things,’ gave us the confidence to quickly increase volume and extend support to additional states.”

Homepoint Monthly Open Orders

Accelerated Onboarding, Instant Results

Impressed with how the dedicated Remote Team and production team handled the pilots, Homepoint moved 100 percent of the volume for its largest state, California, to Doma. Arizona, Illinois, Indiana and Nevada soon followed, and the company opened 724 orders in only the second month since the partnership launched. After the pilot Homepoint further expanded the partnership to Florida and Georgia, with Doma handling 100 percent of the company’s order volume in 13 states.

“Partnering with Doma was crucial to operating through the COVID-19 crisis, and we believe they will prove crucial to our mission of becoming a top-10 mortgage lender by helping us to offer speed, consistency, and superior customer service,” Willie said. “A process that used to take days or weeks now takes hours or an hour.”

In May of 2023, HomePoint announced it was selling the company to Mr. Cooper Group, which resolved in the company shutting down.

Take a copy of this case study with you.

About Doma

Doma is architecting the future of real estate transactions. The company uses machine intelligence and its proprietary technology solutions to transform residential real estate, creating a vastly more simple, efficient, and affordable real estate closing experience. Doma and its family of brands – States Title, North American Title Company (NATC) and North American Title Insurance Company (NATIC) – offer solutions for current and prospective homeowners, lenders, title agents, and real estate professionals. Doma’s clients include some of the largest bank and non-bank lenders in the United States.