In 2021, the pandemic continued to force us to rethink multiple aspects of our lives. The need to embrace technology became more evident throughout the real estate industry, especially the mortgage industry, as regulations and safety measures accelerated the shift away from in-person interactions in favor of online, digital solutions.

For some Americans, this meant their homes became even more permanent workplaces and where they continued to spend most of their time, creating a greater desire for more space, bigger homes and opportunity to relocate outside major cities. Meanwhile, economic factors such as low mortgage interest rates and a short supply of housing combined with unprecedented demand have nonetheless fueled a wild ride in the real estate market unlike what we’ve ever seen.

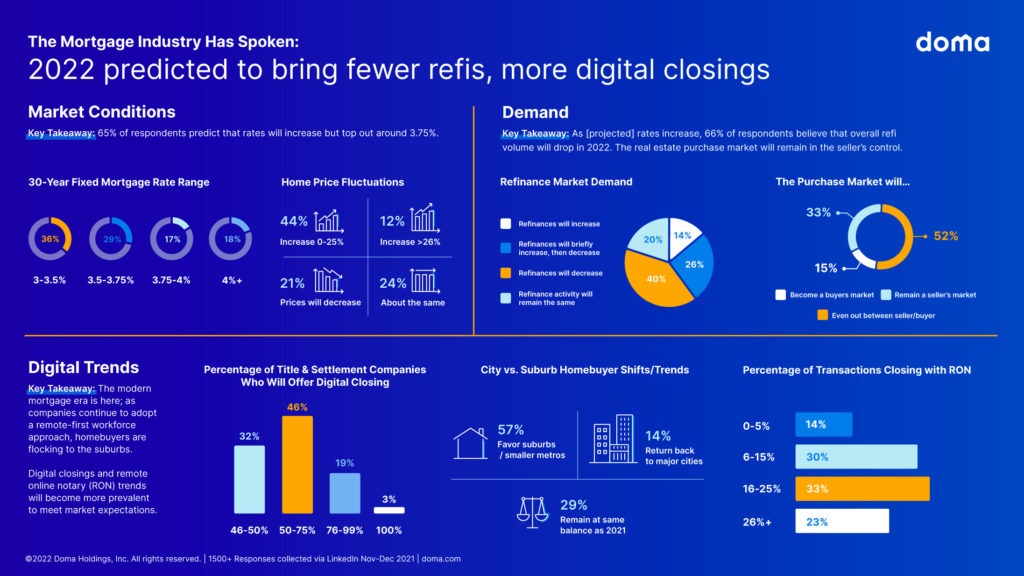

To close out the year, we opened a series of polls on LinkedIn asking real estate and mortgage experts to weigh in on trends and their predictions for what could be another unpredictable year. From mortgage rates to refinance and purchase trends to digitization and more, we collected over 1,500 unique responses exploring what they believe is in store for 2022.

Higher mortgage rates, fewer refinances

For most of 2021, 30-year fixed mortgage rates largely hovered around 3% in tune with the historically low mortgage rates we’ve seen the past two years. But with inflation and new COVID variants causing uncertainty, almost two-thirds (65%) of respondents predicted rates will increase with nearly half of those indicating it will top out at 3.75%

While these low rates helped with the dramatic increase in refinances, a recent Bankrate survey found nearly 75% of homeowners have yet to do so as nearly a quarter believed it was “too much of a hassle/paperwork.” With the possibility of increasing mortgage rates, that number may hold true as 40% of our respondents predict that refinance volume will decrease in 2022.

Closings will only get more digital

The pandemic forced a digital shift in the mortgage closing process and highlighted the overdue need to meet consumers’ growing expectations for more instant modern experiences across all kinds of transactions.

Prior to the pandemic, only 14% of professionals/companies offered digital closings according to a recent ALTA survey. Now, in 2021, 46% offer digital closings. Most of our respondents predict that the trend will continue to increase with 50-75% of title and settlement companies offering digital closings by the end of 2022.

According to that same ALTA survey in July 2021, a little more than 5% of transactions were closed with remote online notary (RON). More than three-quarters of respondents predict that 25% of transactions or less will close with some variation of RON by the end of 2022.

Buyer beware: Expect another seller’s market

We’ve seen the correlation between mortgage rates and refinance/home purchase activity play out countless times over the years, but many experts agree that supply will dictate the market for next year. With supply shortages continuing into 2022, 52% of respondents believe that it will remain a seller’s market.

Home prices increased in August 2021, rising at an annual rate of 19.8%, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index. Fueled by many sources, the rise in prices is historic and especially troubling for first-time home buyers and low-income families. Almost half of our respondents (44%) don’t expect to see that trend slow down.

Some do see a shift away from a seller’s market in the foreseeable future. A business growth expert noted, “I think we are seeing a lot of false ceilings being created. I’m sure home prices will increase a little in 2022 but I predict them to decrease the next year. The decrease will not be dramatic. By 2023 we should hopefully see inventory stabilize and get back to that 5-to-6-month average.”

Suburbs will continue to outshine major cities

As with the shift to digital and many companies continuing to offer work-from-home options for their employees, several 2021 reports indicated people are moving away from dense, major cities to other smaller cities and the suburbs. More than half (57%) of respondents expect this trend to continue in 2022, making smaller suburbs and metros the most favorable location with only 14% predicting a return to major cities.

Embracing technology for the modern world

If we’ve learned anything from the last two years, it’s that we can no longer rely on traditional, arcane and cumbersome processes to keep up with today’s digital world. An instant, modern experience is key to helping everyone involved in the real estate transaction be more successful on a home purchase or refinance, especially as we navigate through unpredictable changes.

Doma is combining machine intelligence and proprietary technology solutions with deep human expertise to make closings vastly simpler and more efficient for current and prospective homeowners, lenders, title agents, and real estate professionals, reducing cost and increasing satisfaction. What used to take days can now be done in minutes.

To learn more, download “Six Shortcuts to a 7 Day Close,” a mortgage industry brief with six practical tips to help shorten the refinance process and more from Sierra Pacific’s Chief Production Officer.