Seamless title and escrow drives increased profit in uncertain times

Mortgage lenders are bleeding. Rates are rising, originations are dropping, buyers are pushing for faster close, and new companies are encroaching on traditional turf. This, paired with an outdated, very manual title and escrow process, makes for an area ripe with opportunity to simplify and enhance the overall customer experience.

To survive and thrive during these uncertain times, lenders and realtors must increase the value of each transaction. Eliminating friction and inefficiency through enhanced technology, machine learning, and predictive analytics is arguably the best way to extract the maximum value from each sale and refinance transaction, increasing profits by up to 35%.

In this whitepaper, we’ll endeavor to share with you three ways that innovation and data driven closings can transform your business and dramatically boost your margins.

“Eliminating friction and inefficiency through enhanced technology, machine learning, and predictive analytics is arguably the best way to extract the maximum value from each sale and refinance transaction, increasing profits by up to 35%.”

Optimizing the Closing Process

The traditional process for title insurance involves a search of public records (sometimes electronic, sometimes paper-based), an examination of the records to eliminate old and duplicative issues, and a long research project to ensure unpaid or improper obligations are resolved prior to closing.

This process of “clearing title” is a requirement for every mortgage, whether originated by a bank or non-bank lender. Lenders expend such effort, time, and money — amounting to 2-12 days of labor and hundreds of dollar per order, or more when there are issues — in clearing title in the traditional process. Invariably, except for the cleanest properties, lenders spend a significant amount of this time on “false positives”, items that appear problematic on title data but are, in reality, harmless.

Here is an all-too-common example of such a false positive:

Sarah would like to refinance her home using a loan from Acme Bank. Many years ago, Sarah had renovated her kitchen but couldn’t afford to pay the contractor on time. As a result, the contractor had filed a mechanic’s lien — a legal instrument that ensured the contractor would get paid ahead of any then-future interests in the house.

Sarah eventually returned to financial health and paid off her overdue renovation bill two years ago, but the contractor forgot to release the mechanic’s lien, and Sarah misplaced her proof of payment. Now, when Sarah’s title company finds the unreleased mechanic’s lien, Acme Bank needs it to be cleared. This delays the closing of Sarah’s refinance as the title company waits for the contractor to release the lien. Finally, after several weeks, the contractor provides evidence that Sarah’s account is in good standing. The issue is crossed off the to-do list and the title company turns to the next issue.

Stories such as Sarah’s are the result of a system typified by unreliable data quality and unreliable actors. Borrowers’ plans are disrupted as the closing takes an unnecessarily long time without good reason. They are left scratching their heads and wondering, “Did that really have to happen? Isn’t there a better way to resolve this type of issue?” And lenders and realtors are stuck footing the bill for extra effort and the back-and-forth required to iterate on the non-issue.

Fortunately, there is a better way. Thanks to technology, there is a way to optimize the closing process for the majority of borrowers. Using both machine learning and predictive analytics, data from all available real estate and title data sources can analyzed instantaneously and intelligently drafted into documents, bringing only relevant information to the attention of those in charge of document processing. This process allows you to quickly dispense of “non-issues” and eliminate much of the curative, manual work for the vast majority of loans.

Doma’s Approach

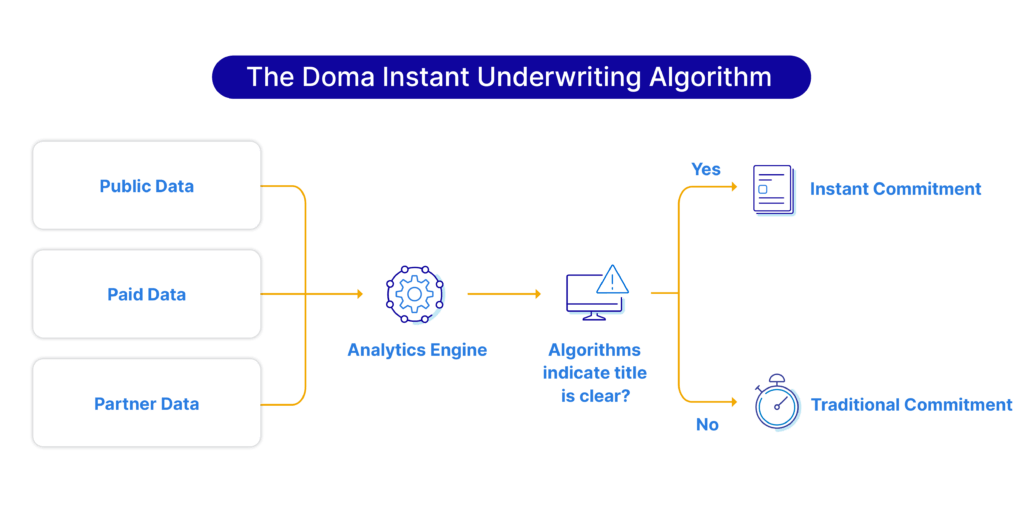

Title is at the heart of any closing process. Doma was founded on the idea that we could make a better experience for all parties involved in a mortgage process through data and predictive analytics. Our proprietary technology and data science algorithms instantly estimate the probability that any given property will have true, verifiable title issues, automatically clearing the rest and allowing them to reach clear-to-close status faster, with more certainty.

How to Achieve a 35% Increase in Profit Margins

In 85% of cases in the states where we operate, our underwriting algorithm instantly (within minutes) issues clear-to-close ALTA commitments free of any defects, because it detects an extremely low likelihood that any issues that might come up in a title search are true and verifiable issues (nationwide, our data sources indicate only roughly 7% of transactions contain verifiable title problems). For the other 15%, we conduct a traditional search and research process.

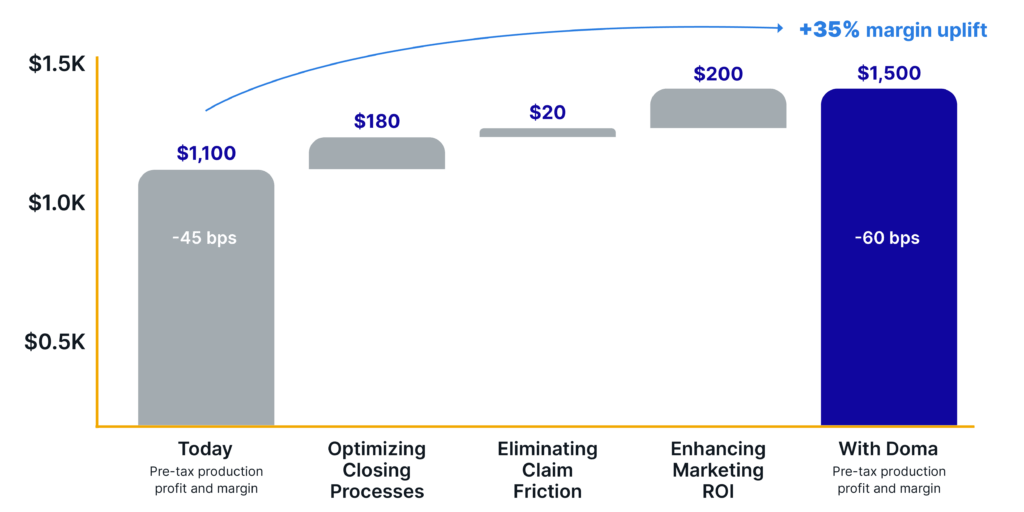

Our analysis indicates that this optimization, driven by machine learning, will drive a 35% relative uplift (0.25% absolute uplift) in pre-tax origination margin for institution lenders1.

1Assumes a 33% reduction in closing FTE costs. Processing Personnel Expense per loan of $1.65K based on MBA Report of which we assume closing FTE costs represent 33% or $0.55K per loan

Eliminating Claim Friction

Lenders, secondary market investors, and homeowners rely on title insurance to provide peace of mind and protection against any defects that may encumber their rights to their properties. Too often, when there is an issue, such as a missed lien, the recovery process is cumbersome and costly. Mortgage originators may face costly putbacks from the secondary market for missed liens, needing to take on a non-performing loan onto their balance sheet. Sometimes these problems stem from the fact that traditional title underwriters can be slow to respond to, resolve, and pay claims.

Title claims should be as frictionless as in any other service-oriented insurance business. After all, people purchase title insurance, so they expect great customer service when they need to use that insurance. Consumers have come to expect that financial institutions have all the necessary information recorded and stored through secure technology, so claims should be resolved quickly. The gold standard for service would mean an agreement between the customer and lender to pay valid claims in a timely manner, such that lenders and homeowners are not unduly inconvenienced and worse off financially.

Doma’s Approach

At Doma we understand that title claims can be stressful and frustrating to deal with for all parties involved. Fortunately, the precision of our data science models is great enough that we can confidently serve the customer quickly and set the lender at ease. Because of this predictability, we promise to either pay or resolve most denominated title claims, such as missed liens, under $10,000 within 90 days of receiving the claim. This time window is sufficiently short that mortgage lenders can be sure they will not need to buy back loans sold to the secondary markets because of small title claims. And we make this quick resolution promise to homeowners and lenders alike.

This process results in less litigation, and less frustrating back-and-forth on title claims; we estimate an additional $20 margin for lenders on each mortgage, as a result2.

2Assumes a 33% reduction in claim costs. All Other Production Support Personnel Expense per loan of $0.70K based on MBA Report is assumed to include Claim expenses. Claim expenses assumed to be $5.00K per claim with a 1% claim incidence rate resulting in a $0.05K cost per loan.

Enhancing Marketing ROI

While optimizing the closing process and eliminating claim friction are certainly low hanging fruit for improving margins, evaluating your marketing tactics and how you package your offerings may provide those additional profits you need when there’s a drop in originations. Companies that win when the going gets tough don’t use the same tactics as their competitors to gain share. They’re looking at ways to improve their service to their customer, while also considering operational efficiencies. Armed with powerful machine learning and best-in-class service, realtors and lenders should consider these marketing tactics to boast a true differentiation in an otherwise hyper-competitive market.

First, by pre-identifying properties that are expected to be easy to clear-to-close, realtors and lenders gain a competitive edge. They can specifically target these properties with more competitive offerings. For instance, lenders may offer tailored rates that are more attractive with shorter rate lock periods given these properties are likely to have fewer closing complications.

Second, the extremely competitive nature of the real estate and mortgage industry means every point of differentiation counts, as most services today are quickly commoditized. Marketing messages can be customized thereby making them more effective and painting a greater contrast with competitors.

Doma’s Approach

Doma is focused on delivering the best total value for our customer. While it’s easy to understand how optimization of the closing process can provide substantial savings, it’s our belief that this is just one part of the total picture.

We estimate that transactions segmented in a pre-identification process will close more efficiently. Assuming a modest 6 day improvement in closing speed, lenders using Doma can expect a $100/loan average boost in margin just from this direct marketing approach, and realtors can expect more free time to grow their business.

Additionally, using the unique features of the Doma closing experience, marketing messages can be customized. We estimate that even a 5% improvement on a typical marketing spend of $1950 per closed transaction will yield $100 margin improvement per transaction for lenders.

Conclusion

Based on industry forecasts, lenders and realtors face significant challenges in the coming economic times: they need to find ways to drive extended profit from current transaction volumes, and they need to find ways to boost these volumes. By focusing on data-driven closings powered by machine learning and predictive analytics, they can achieve both targets. Technologies that remove inefficiencies from the title and settlement process, ease the loan lifecycle through better management of nonperforming loans, and enhance the power of the existing marketing book are the key to growth in uncertain times.