1. Move fast with digital-first offerings to keep up

In 2021, the home equity financing market grew at a rate of 31%. The total amount of home equity available to homeowners is at an all-time historical high of $27.8 trillion.

Homeowners have seen incredible appreciation in their home’s values over the past two to three years, and on average now have $153,000 in untapped equity.

To take advantage of this market opportunity, lenders need to be equipped with digital-first solutions that enable them to convert customers and originate loans quickly while conditions are favorable.

2. Win the online search battle

54% of home equity originations begin online, and most of these consumers start their home equity journey through a web search. This means that showing up first in the search results of your target customer is one of the foundational building blocks of a successful customer acquisition strategy.

To take advantage of the growing home equity market opportunity, your team should leverage search engine optimization (SEO) tools to ensure relevance, in addition use paid search ads to further bolster your organization’s position. But showing up first in the search results is not enough in itself. Make sure to use web analytics software to measure how long users stay on your site and what content gets the most engagement.

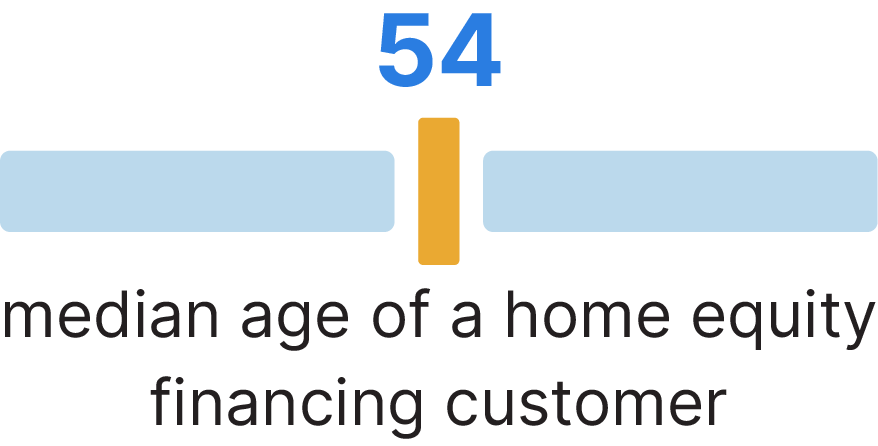

3. Make your digital experiences accessible across demographics

The median age of a home equity financing customer is 54 years old. States with a higher percentage of retirees have up to three times more search interest in home equity financing.

Therefore, it is important that all touchpoints of the customer lifecycle address these unique needs, whether it’s related to website design, mobile app accessibility, or marketing copy.

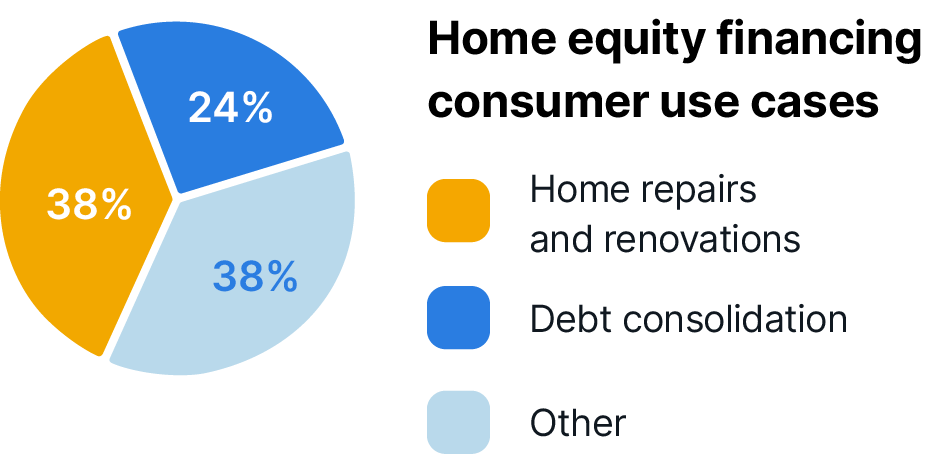

4. Target customers with the right use case to maximize your conversion rate

38% of consumers use their financing for home repairs and renovations, and 24% use it to consolidate debt. For critical purposes like this, home equity loans and lines of credit offer far lower risk and interest rates compared to other types of financing like personal loans, credit cards, or cash advances.

These are the types of customers to focus your sales and marketing outreach on. Chances are these customers are not fully aware that home equity financing could be an ideal solution for their situation.

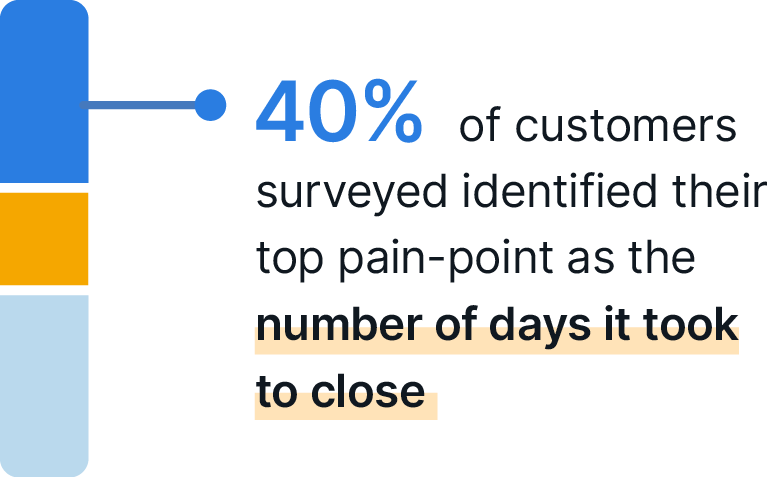

5. Reduce the days it takes to close

40% of customers surveyed responded that their top pain-point was the number of days it took to close on their financing. On average, it took 36 days for a home equity product to close in 2021. For customers who have become accustomed to instant streaming, 20-minute food delivery, and 2-day shipping, this amount of time is unacceptable.

Customers who are doing renovations or consolidating debt can’t wait this long and will turn to alternative financing like credit cards or personal loans.

6. Deliver outstanding customer service

20% of customers surveyed responded that their top pain-point was the lack of good customer service. Lenders can utilize instant underwriting technology to help reduce manual processes and overhead needed to close a home equity transaction. This frees up time to be more engaged throughout the customer lifecycle.

Providing a single point of contact (SPOC) for the customer helps to streamline communication and create a seamless closing experience.

Contact one of our representatives at lender.sales@doma.com today for pricing information and to find out how Doma can transform your home equity business.