How Efficiency Helps Doma’s Customers to Unlock Margin Uplift

“Expediency is critical in loan transactions,” writes Doma CEO Max Simkoff in a Forbes article. “The longer it takes to close a loan, the higher the risk of losing the deal. The time to close has increased across the board. According to mortgage software company Ellie Mae, the average closing time is 46 days for a purchase transaction and 49 days for a refinance.”

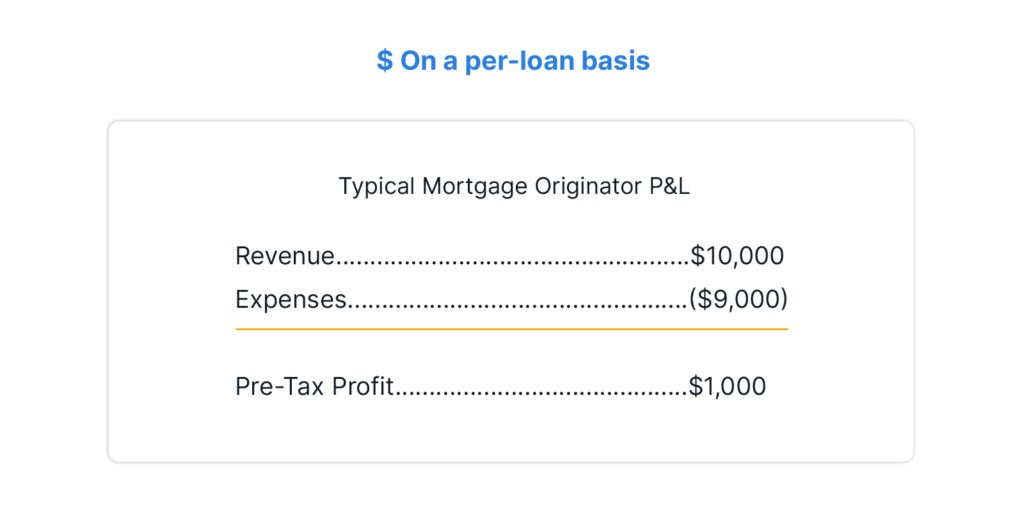

Perhaps what the mortgage industry needs isn’t necessarily “more haste.” In fact, it needs more speed. Let’s presume a lender makes an average of $10,000 per loan, and it costs $9,000 in expenses for the lender to complete the transaction. In our hypothetical, the profit is $1,000:

“The longer it takes to close a loan, the higher the risk of losing the deal.”

– Max Simkoff | CEO, Doma

So where and how does Doma help lenders find these profitable efficiencies? We recently covered some of the how in our blog, Human-Technology Collaboration in Customer Satisfaction. As for where we uncover efficiencies, the short answer is: Everywhere we can.

Our primary focus is helping your loan operations team to become more efficient by using technology to complement optimized processes, supported by our ops service model, ensuring that the closing process is more efficient for your customers.

Assuming you save just one percent on revenue and expenses through evolving efficiencies with us, the input figures change to $10,100, and $8,910, and the profit output has grown from $1,000 to $1,190, which represents a $190 or 1.9-percent lift on a single loan.

Getting the most out of your operations team

Employee productivity and earnings

With our combination of machine intelligence-driven technology and customer success and service offering, your team can spend less time on every file, with fewer touches, empowering your team to process more files overall in the same work period.

Further, Doma customers have seen pull-through rates (the likelihood of a loan application resulting in a closed loan) improve, and we continue to develop solutions that will provide a greater lift over time. But beyond saving time, the greater certainty of a file closing successfully provides all parties – employees, third parties, and customers – a certain peace of mind that allows professionals to focus on the next file.

Being able to transact faster provides greater opportunity to make money in any given month or quarter, which in turn leads to increased earnings for all involved, especially when hitting bonus targets is thrown into the mix. And because Doma’s rates are on average lower than other providers, our customers tell us they find it far easier to attract customers.

Workforce planning

In an industry where employee levels are scaled up and down relative to seasonal and market demand, it is important to be transparent about needs. But although certainty is linked closely to market forces out of lenders’ control, imagine if instead of scaling your workforce like a yo-yo, you kept a relatively stable employee pool and simply adjusted employees’ responsibilities and workflows.

By reducing the number of hours required to close a transaction, and in turn, the average employee cost per file, you have the flexibility to streamline employee, compensation, and occupancy totals – all of which impact your bottom line.

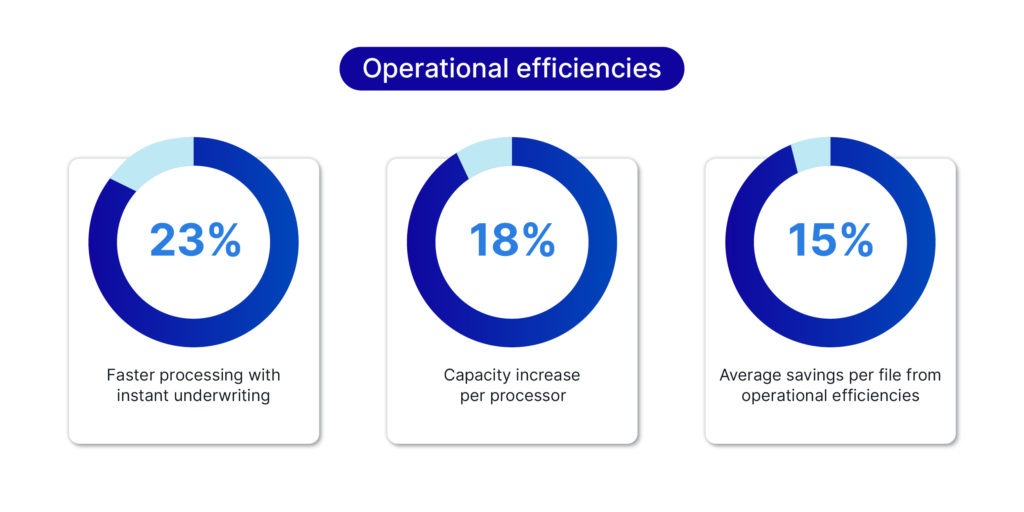

Operational efficiencies

By leveraging Doma’s instant title solutions, it is possible to realize valuable operational efficiencies. In fact, for one customer, a top-five national lender, we calculated that with 80 percent of files being processed instantly, and using a conservative average time saving per file of 45 minutes versus traditional underwriting, they processed files 23 percent faster with us.

With the same instant-versus-traditional ratio, each processor could process about 140 more files per year, an increase of 18 percent annually. The top-five lender also enjoyed an average 15 percent timesaving per file, for potential annualized savings of more than $1 million when added to time and labor savings.

What’s more, according to internal pull-through rate data, 73 percent of instantly underwritten files closed successfully, versus 60 percent of traditionally underwritten files. That represents 22 percent more files closing, proving what Max said in Forbes: “Expediency is critical in loan transactions.”

Better Mortgage Experiences: Give Each File the Attention it Deserves

“The customer experience is definitely important. We give them what they want. They can see all the answers customized to their situation. What makes my company, my process, so good is that we give them the control. They are the ones that fill out our application. They are the ones that submit the document to us. They are the ones that monitor the rate. They are the ones to tell us to lock the rate. So they are in control of the entire process, not us.”

That was one of many insights Loan Factory Founder and CEO Thuan Nguyen shared in a previous Ask the Expert webinar. You might be wondering why the customer experience came up in a webinar titled “The Age of the Tech-Assisted Mortgage.” Because, as nice as better processes, time-saving automations, and easier closings are for lenders, brokers, underwriters, and title and escrow providers, arranging mortgages is a relationship-centric business. Without satisfying the customer on this transaction, how can you hope to build a pipeline of future transactions?

“The customer experience is definitely important. We give them what they want.”

– Thuan Nguyen | Founder, CEO of Loan Factory

In a recent email, a frustrated homebuyer, they stated “Hi folks! Just thought I’d let you know we’re closing on a house this Friday, and the process is, just as Max has said, so preposterously complicated. It makes no sense that it’s this complicated. I have spent way too much time dealing with paperwork, multiple wire transfers, literally 7 different people weighing in on all the things we’re supposed to do, etc. Also, virtual closings are apparently legal in Georgia, but not everywhere is set up for it, so they’re letting us sit in our car outside the lawyer’s office on Friday.”

This level of customer frustration is all too common in the mortgage industry. Although not every closing experience is this cumbersome, it is advantageous to eliminate as much confusion and inconvenience as possible for your customers, who are often a valuable referral source for future business.

A better experience for lenders provides a better experience for homeowners

Doma offers customers a dedicated team of professionals from the executive level to the file level. We can instantly underwrite title insurance for more than 80 percent of files with our patented technology, and our Instant Closing Disclosure, which removes the need for fee collaboration, is modernizing outdated settlement processes.

Yes, for loan officers and the other professionals involved – lenders, real estate agents and brokers, attorneys, and notaries – all of this saves time and money. For the top-five lender mentioned above, we have already helped them achieve a 93-percent Customer Satisfaction score, 43-minute faster processing on instant files, a 10-percent reduction in days to close, and recently, a 5/5 stars customer rating for our Digital Closing pilot.

According to global management consultant firm, McKinsey & Company, maximizing satisfaction across the customer journey has the potential to increase customer satisfaction by 20 percent, lift revenue by 15 percent, and lower the cost of serving customers by as much as 20 percent. But the justification for all this effort-saving is so the end customer can have the best experience possible.

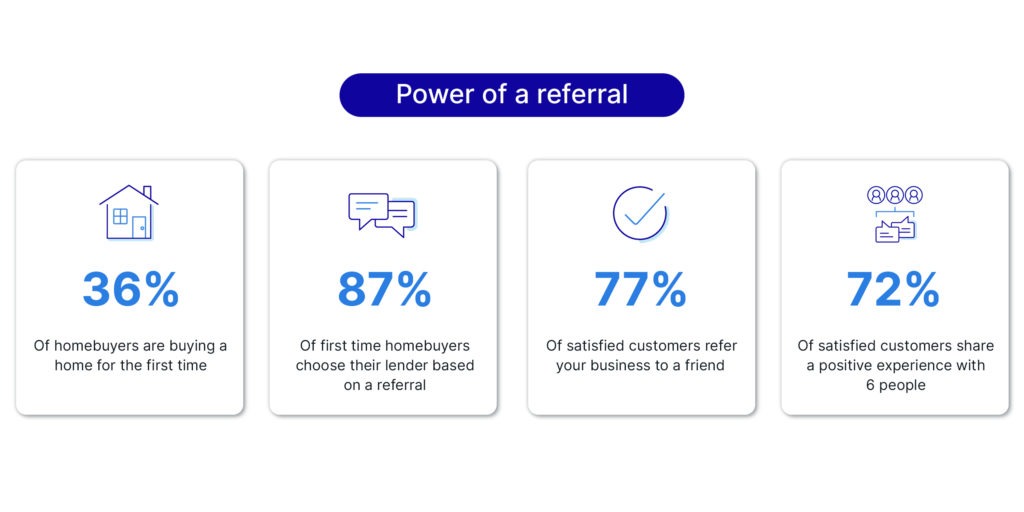

According to data from STRATMOR’s MortgageSAT Borrower Satisfaction Program, 36 percent of homebuyers are closing a mortgage loan for the first time, and 87 percent of those first-time homebuyers choose their lender based on a personal referral. If you consider that customers who have a positive brand experience are 77 percent more likely to refer your business to a friend, and 72 percent of customers will share a positive experience with six or more people, the benefits multiply.

For processors, providing a positive customer experience means spending the right amount of time on each file, whether clear title can be issued in less than a minute, or the file requires more extensive attention and curation. Customers are satisfied when their closing takes place in the timeframe they are promised. Considering the borrower’s convenience and meeting their expectations is crucial for ensuring a satisfactory experience. That’s what Thuan focuses on, putting as much of the transaction – from application to close – in the control of the customer. Isn’t that preferable to closing on or refinancing your dream home from a car on a hot Georgia day?

According to our internal data, our instant title solution shaved 10 days from our lender partners’ closings. We spend the appropriate amount of time on each customer’s file. Barring complex title issues that require special expertise and attention, you can expect most files to close expeditiously and without unclear delays.

Affordable Title and Escrow You Can Scale to Future-Proof Your Lending

“Typically, a customer has to prioritize two out of three factors: Cost, quality of delivery, and speed,” says Jay Promisco, Chief Production Officer at Sierra Pacific. “Doma is highly competitive on price across the country, and in Minnesota, its settlement services cost half as much.”

Jay’s not wrong – due to greater efficiencies across the system, we can offer lower title and escrow fees than most other title companies. Generally, our fees are up to 35 percent lower than other title providers in states where possible. What’s more, our fees are all-inclusive, meaning that itemized services such as courier costs and delivery fees are rolled into a flat fee for a given house pricing band in some states.

Note: Our fees do not include some charges dictated by local law, including city, county, and state taxes and recording charges; attorney fees and costs; third-party vendor fees; or lender fees and closing costs.

“Typically a customer has to prioritize two out of three factors: cost, quality of delivery, and speed.”

– Jay Promisco, Chief Production Officer, Sierra Pacific

When Jay first introduced Doma to his team, emphasizing the affordability of choosing us over other title providers they had used previously, the response was one of disbelief: “Surely, cheaper and faster means useless!” – most mortgage lenders are accustomed to receiving only two of these three factors. But soon, loan servicers at Sierra Pacific saw that Doma has completed the three pillars of cheaper, faster, and of equal or better quality:

According to McKinsey & Company, companies that make significant improvements in operational performance can increase the win rate of offers by 20 to 40 percent (while also lowering churn by 10 to 15 percent and service costs by up to half). In other words, for every 10 quotes that result in a homebuyer or owner moving forward with a lender, between two and four more will also move forward.

“Whatever the Doma team is doing to ensure quality delivery, it’s working – I have had exactly zero customer issues,” says Jay. “Because Doma massively reduces manual input, closing takes us 75 percent less time from start to finish.”

Increased wallet share, better ROI

It almost goes without saying that when a lender processes hundreds or even thousands of quotes and files a month, the benefits multiply. Unfortunately, so can errors. To mitigate this concern, Doma enters into a pilot program with each lender customer to maximize efficiencies and resolve issues prior to scaling up.

In the same McKinsey & Company report mentioned above, the global management consultancy firm found that making improvements to the select-and-buy phase of the buyer’s journey yields a 5-10 percent increase in wallet share. Our comprehensive customer onboarding process and focused pilot programs result in smoother closings and financial benefits for lenders and consumers alike.

According to the McKinsey report, one large bank eliminated 15 process steps to enable account opening anytime and anywhere: The effort boosted self-service sales from 0 to more than 33 percent of total sales with 50-percent higher conversion rates, and reduced cycle time to 10 minutes compared with two to six days previously. These changes decreased cost to serve by 40 percent and tripled the retention rate of relocating customers.

A satisfied customer can often be a repeat customer, increasing your customer retention. Lenders that offer other financial products and services – such as checking and savings accounts, credit cards, and home equity loans – can cross-sell to satisfied customers. Current banking customers can also apply for a mortgage loan with their lending institution if they are content with their relationship.

“A process that formerly took days and even weeks is now taking hours.”

– Willie Newman, President and CEO, Homepoint Financial

Future-proof and ready to scale

The equation is simple: More customers, using more financial products and services, provides more revenue overall. But what’s at stake is more than that: it’s future-proofing your business so you don’t lag behind the competition.

According to Jay, closing transactions with Doma has reduced costs and improved loan processing times. They have improved the lender’s value proposition, put them in a position to scale, and in doing so, given Sierra Pacific the greatest advantage: A business with streamlined operations that are well-equipped to withstand fluctuating market and other forces.

As Jay explains “Our value proposition is now a combination of lower rate fees, great service, accurate work, and industry-leading turnaround times. We don’t have to compromise, and neither do our customers. Doma gives us a competitive advantage on every transaction, with every returning customer and in the industry at-large. This is the Amazon effect we were looking for, and we are excited to roll out predictive underwriting for wider adoption.”

“Our value proposition is now a combination of lower rate fees, great service, accurate work, and industry-leading turnaround times.”

– Jay Promisco, Chief Production Officer, Sierra Pacific

To find out how our efficient title solutions, dedication to improving the customer experience, and affordable service can improve your lending operations, contact us at lender.sales@doma.com