Local expertise and innovative technology mean better closings

Centralized Lender Services

Our technology-driven solutions help lenders close faster and deliver better customer experiences

Title Insurance

Our underwriting team has over six decades of experience and one of the industry’s lowest claims ratios

Best-in-class title and escrow

Get in touchTitle Agent Resources

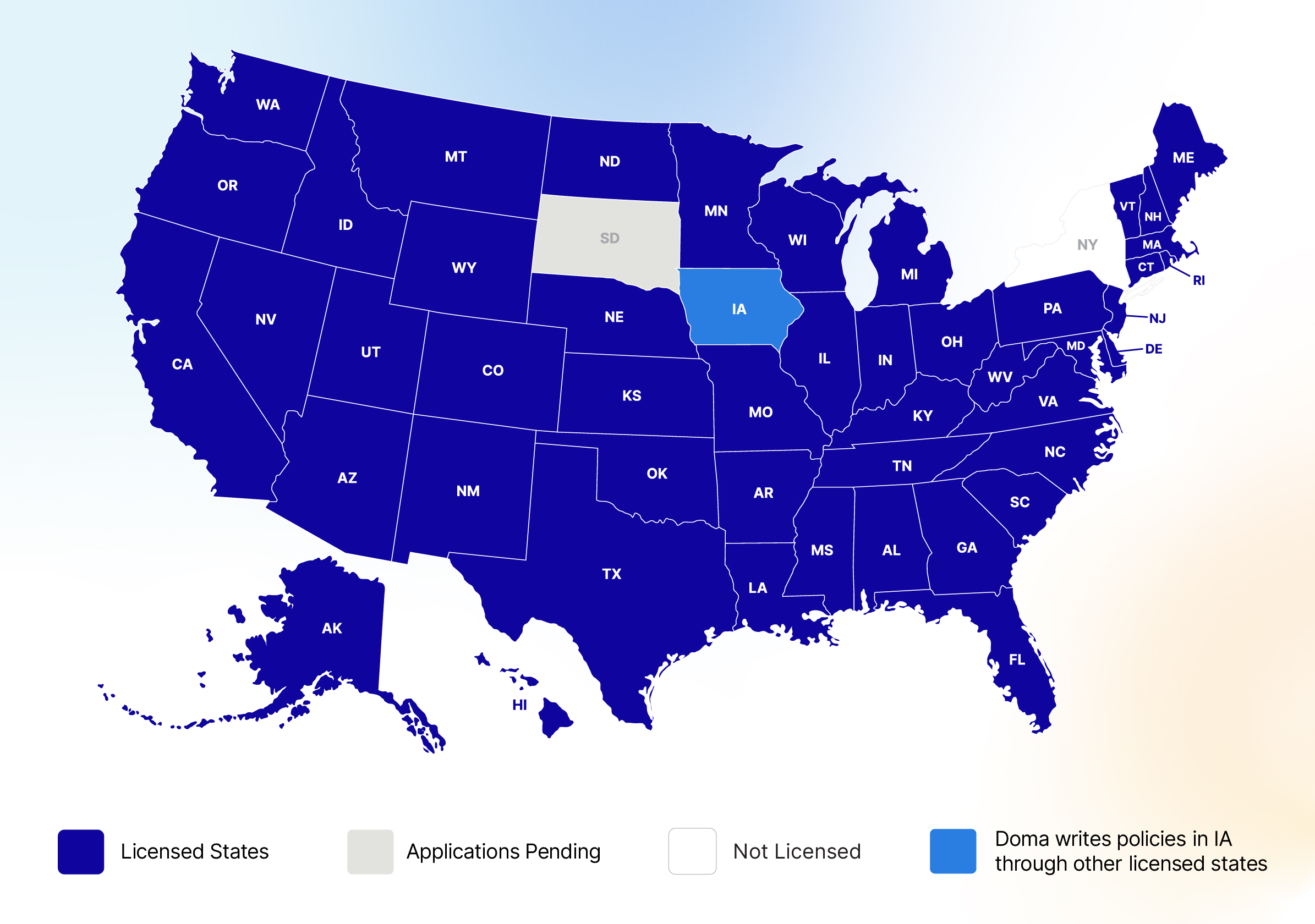

We are where you are

Doma Title Insurance is licensed to operate in 48 states and the District of Columbia.

“With Doma a process that used to take days or weeks now takes less than a few hours.”

Top Ten Lender

President and CEO, of Top Ten Lender

The Doma team … gives my staff the confidence to issue a Doma title policy.

Raymond Manuel

VP of Operations | National Title Solutions, Inc.

Come work with us

We believe that a diverse set of backgrounds, experiences, and perspectives is essential to making our vision a reality and creating a great place to work. We’d love for you to consider joining us on our journey.

Explore Open Positions