Mortgage Lending in the Post-Pandemic Era

In 2021, refinancing volumes reached record highs, as the origination volumes showed few effects of the COVID-19 pandemic. But after years of uninterrupted gains in refinance loan volume, the rules are changing – a lot.

First, inflation levels unseen in 30-40 years are putting upward pressure on interest rates, which means homeowners who had previously procrastinated are rushing to catch the last wave of historically low rates. Costs are also rising. The average cost of a mortgage origination ranges from $7,000-9,000, and it takes an average of more than 45 days to complete that refinance process – an increasingly frustrating delay for millennials accustomed to two-day shipping and instant streaming. And of course, big banks continue to expand their footprints and encroach on local lenders’ turf, while fintech lenders – who can often slash as much as 10 days off the refinancing cycle – are increasingly elbowing out established players.

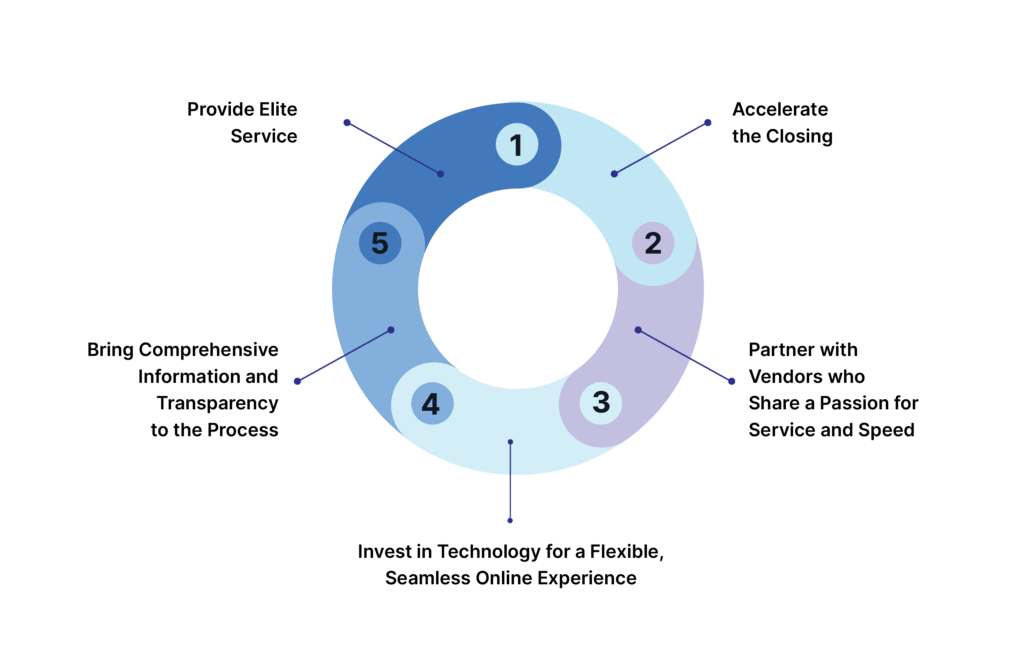

Fortunately, technology is creating new opportunities to deliver elite service, accelerated closing cycles, and online-centric refinancing experiences that new borrowers are demanding The five-stage “flywheel” creates and sustains momentum for mortgage brokers who want to build a larger and healthier pipeline, even while competing against these new headwinds.

Pipeline Flywheel

1. Provide Elite Service

Providing the best possible loan rates remains the heart and soul of a mortgage broker’s business, but there’s another, equally important, factor: elite service. While consumers increasingly prefer a self-directed borrowing experience (often initiated on the Internet), most borrowers bring a limited understanding of all that goes into the mortgage process. Your ability to become a trusted expert not only strengthens your ability to serve and satisfy your customer, it generates important repeat and referral business. Customers continually return to a trusted relationship that features consistently outstanding service – which can drive a 10-15% increase in repeat customers.

2. Accelerate the Closing

Consumers crave speed and in mortgage lending customer satisfaction drops approximately 15% if the lender takes more than 10 days to provide a decision. Borrowers expect – and deserve – a speedier and more reliable closing process, that’s not hamstrung by needless delays and inefficiencies. Instead, mortgage brokers must focus on developing faster processes that reduce “touches” and reduce the days to close.

3. Partner with Vendors Who Share a Passion for Service and Speed

Dissatisfied customers (particularly) millennials are unafraid to switch banks if they are displeased with their experiences. For many brokers, it’s sometimes too easy to fall into the “business as usual” mode and rely on the same title and escrow partners for years. It might be time to rethink those partnerships and identify partners who go beyond broker needs to focus on improving the borrower experience as well.

4. Invest in Technology

Borrowers value the convenience, ease of use, and time savings that new technologies can bring to the lending process. One survey found that 60% of borrowers would be open to an entirely online mortgage experience – without phone or in-person support. And 69% of borrowers preferred to submit financial documents using digital tools. Unfortunately, only 7% of banks can handle loan products digitally from start to finish. Moving forward, the smart strategy is to apply technology to administrative tasks (e.g. collecting documents for mortgage approval), while you focus on the relationship.

5. Provide Comprehensive Information and Transparency

With the transition to remote and online buying experiences (a transition accelerated by the COVID-19 pandemic, of course), consumers want self-serve information as well as readily available, trustworthy, and clear information. So where do they turn? Remarkably, nearly half (47%) of borrowers consult family and friends for mortgage information, showing just how significant the knowledge gap is for buyers and borrowers. The key: transparency. Anything that obscures the process can lead to hesitancy, anxiety, and dissatisfaction. Brokers who provide transparency can regain their rightful role as the process expert and reassert their ability to guide the customer.

By adopting this “flywheel strategy,” brokers can enhance customer satisfaction, increase repeat business, and generate greater volumes of referrals from happy borrowers who no longer contend with tiresome delays and outdated processes. Instead of “your father’s refinancing process,” savvy mortgage brokers are tearing up the old rulebooks and embracing technology as the more efficient and more profitable way to improve their operations, increase volume, and develop (and maintain) a thriving pipeline.

To learn more, download our 5 Steps to Building a Predictable Pipeline Executive Brief.